Guru Grantham on stocks/economy disconnect

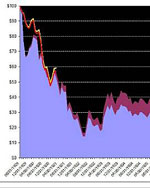

October 30, 2009Jon Brooks 1 Comment »Yesterday we reported on well-regarded assets manager Jeremy Grantham’s prediction that the stock market is cruising for a 15-20% correction sometime this winter. In a section  titled “The Last Hurrah and Markets Being Silly Again,” he makes the comparison between the current rally and the 46% gain in the S&P 500 between November and April of 1930–after the initial market crash in October. That was before the index embarked on a vicious two-year decline that reached into the bowels of equities hell. Of course, when considering any market prognostication, it may be wise to heed the old axiom, “Nobody knows nuthin’.” Still, Grantham’s analysis is interesting and worth a read:

titled “The Last Hurrah and Markets Being Silly Again,” he makes the comparison between the current rally and the 46% gain in the S&P 500 between November and April of 1930–after the initial market crash in October. That was before the index embarked on a vicious two-year decline that reached into the bowels of equities hell. Of course, when considering any market prognostication, it may be wise to heed the old axiom, “Nobody knows nuthin’.” Still, Grantham’s analysis is interesting and worth a read:

The idea behind my forecast six months ago was that regardless of the fundamentals, there would be a sharp rally. After a very large decline and a period of somewhat blind panic, it is simply the nature of the beast.

After the sharp decline in the fall of 1929, the S&P 500 rallied 46% from its low in November to the rally high of April 12, 1930. It then, of course, fell by over 80%. But on April 12 it was once again overpriced; it was down only 18% from its peak and was back to the level of June 1929. But what a difference there was in the outlook between June 1929 and April 1930!…By April 1930, unemployment had doubled and industrial production had dropped from +16% to -9% in 5 months, which may be the world record in economic deterioration. Worse, in 1930 there was no extra liquidity flowing around and absolutely no moral hazard. “Liquidate the labor, liquidate the stocks, liquidate the farmers” was their version. Yet the market rose 46%.

How could it do this in the face of a world going to hell?

My theory is that the market always displayed a belief in a type of primitive market efficiency decades before the academics took it up. It is a belief that if the market once sold much higher, it must mean something. And in the case of 1930, hadn’t Irving Fisher, arguably the greatest American economist of the century, said that the 1929 highs were completely justified and that it was the decline that was hysterical pessimism? Hadn’t E.L. Smith also explained in his Common Stocks as Long Term Investments (1924) – a startling precursor to Jeremy Siegel’s dangerous book Stocks for the Long Run (1994) –that stocks would always beat bonds by divine right? And there is always someone of the “Dow 36,000” persuasion to reinforce our need to believe that as markets decline, higher prices in previous peaks must surely have meant something, and not merely have been unjustified bubbly bursts of enthusiasm and momentum.

Today there has been so much more varied encouragement for a rally than existed in 1930. The higher prices preceding this crash (that were far above both trend and fair value) had lasted for many years; from 1996 through 2001 and from 2003 through mid-2008. This time, we also saw history’s greatest stimulus program, despearate bailouts, and clear promises of years of low rates. As mentioned six months ago, in the third year of the Presidential Cycle, a tiny fraction of the current level of moral hazard and easy money has done its typically great job of driving equity markets and speculation higher. In total, therefore, it should be no surprise to historians that this rally has handsomely beaten 46%, and would probably have done so whether the actual economic recovery was deemed a pleasant surprise or not. Looking at previous “last hurrahs,” it should also have been expected that any rally this time would be tilted toward risk-taking and, the more stimulus and moral hazard, the bigger the tilt. I must say, though, that I never expected such an extreme tilt to risk-taking: it’s practically a cliff! Never mess with the Fed, I guess. Although, looking at the record, these dramatic short-term resuscitations do seem to breed severe problems down the road. So, probably, we will continue to live in exciting times, which is not all bad in our business

Oy vey and happy halloween.

November 2nd, 2009 at 6:49 pm

[...] Guru Grantham on stocks/economy disconnect [...]