September swoon?

September 1, 2009Jon Brooks 2 Comments » September is the cruelest month – for the stock market. According to the data, if the leaves have started to fall, so have the major indices. In September, the Dow and S&P 500 have dropped on an average of 22 out of 30 days, the Nasdaq 17 of 30.

September is the cruelest month – for the stock market. According to the data, if the leaves have started to fall, so have the major indices. In September, the Dow and S&P 500 have dropped on an average of 22 out of 30 days, the Nasdaq 17 of 30.

Some of the analysts and investors who called a bottom in March, when the markets hit their worst levels in more than a decade, now say they are detecting a peak in share prices, and they warn that stocks could be headed for a sharp pullback.

Everyone’s twitchy, especially after last year’s autumn disaster. 401k holders, daytrading dabblers, compulsive plungers. If September Day One is any indication, an implosion—self-fulfilling or otherwise—may be in the works. Asks “The Reformed Broker,” referring to the sharp sell-off: Did We Fall Off The Bull Today?

Some market prediction sites, flaunting mysteriously annotated charts, are prepping their paying customers for an assets holocaust. At Main Line Investors, the teaser for non-subscribers: “Stocks Fall Sharply Tuesday. Read Tuesday Evening’s Market Update for the latest on where prices are headed next. It will soon be time to prepare for catastrophic wave (C) down…”

The technical analysis guys often speak in the rhythmic intonations of religious evangelists—true believers in their arcane knowledge, delvers into deep data who can pluck the right numbers from the morass to predict tomorrow’s outcome. Cryptic jargon abounds. From BigWaveTrading’s Aug. 31 video:On any financial site, these days, you’re never more than a click or two away from a skittish analysis. The eminent Robert Reich, in late July, on the market’s false optimism:This is the first rally of this long duration where I got zero perfect set-ups, that is, a bounce off the 50-day moving average and a break out of above some sort of resistance, either a cup-based, cup-with-handle, flat base on flat base, I don’t care whatever it is, whatever it is has to be a bounce off 50-day moving average and a break-out.

Doug Noland runs the Prudent Bear Fund, so his fur, claws, and love of other people’s honey comes naturally. The man who oversaw a 16% return from 2006-8 writes in his August 28 Credit Bubble Bulletin:Wall Street is in the business of cheer leading, even when there’s really nothing to cheer about. It wants investors to think positively, on the assumption that positive thinking can be a self-fulfilling prophesy: If investors begin putting more money into the market, then the market will automatically rise, leading more investors to put in more money — until, that is, the rally ends because nothing has fundamentally changed in the real economy.

Hedge fund manager Doug Kass, once called a “perma-bear,” surprised market watchers when he (correctly) called the bottom in March. Now he’s reverting to form. From Seeking Alpha:Many believe the economy’s previous growth trajectory can be reestablished and the great bull market resumed. Others simply see a very fruitful speculative backdrop. Most believe that the recovering markets are a reflection of growth prospects and that the buoyant stock market is discounting the return of the economy to sound footing. The bullish consensus believes economic recovery will work to cure housing and financial sector ills, as it did during the nineties.

I believe the bullish consensus is misguided. First and foremost, it is the Credit system driving the real economy – not vice-versa. Only massive fiscal and monetary stimulus was capable of stabilizing the system…With the banking system and Wall Street finance severely impaired, “federal” (Treasury, agency, GSE MBS) Credit will account for the vast majority of system Credit growth this year.

The unprecedented expansion of “federal” Credit has stabilized the system and incited a speculative run in the stock market. But I just don’t see the mechanism for private-sector Credit to recover to the point of carrying the heavy load necessary to sufficiently finance the gluttonous U.S. economy. I don’t see a new boom in Wall Street Credit instruments in the offing, and it’s difficult to see how bank Credit can recover adequately on its own.

This time around, (Kass is) calling for a top in the market for the year and has been assembling a short position. His contrarianism is the polar opposite this time around as he writes,

“To most investors, today the fear of being in has now been eclipsed by the fear of being out as the animal spirits are in full force. Bears are now scarce to nonexistent in the face of steady price gains in equity and credit prices. As if the movie is now being shown in reverse, the bull is persistent, stock corrections are remarkably shallow, cash reserves at mutual funds have been depleted, and hedge funds hold their highest net long positions in many moons.”

Continues the post, “many a contrarian will say that when the retail/’dumb’ money rushes in, it is time to get out.”

On the InvestmentWatch blog, “10 pins for the stock market bubble” lays out the case, from unemployment to declining tax revenues to a commercial real estate crash, for a double-dip into extreme bear territory, ending with, “the second crash would make today’s look like kids’ stuff.”

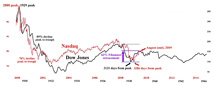

The same blog sports a chart comparing the current market trajectory to the 1929-39 crash period. The Big Picture blog finds a similar parallel. So what do Joe and Jane Investor, who fights the daily battle to regulate their greed/fear switch, think? Some sample posts, gleaned from stock message boards:

So what do Joe and Jane Investor, who fights the daily battle to regulate their greed/fear switch, think? Some sample posts, gleaned from stock message boards:

Of course, you can find the exact opposite view to every opinion expressed here. If it were that easy to see order in the market’s roiling fluctuations, there’d be no market, would there?I am pulling my retirement account back to cash by end of the month and I have some money sitting on the sidelines. I also will be selling most, if not all my stocks. I am really bearish long term though, I just do not see the US bouncing back anytime soon. If the floor drops out I will be all in for sure though.

———————————————————————————————————————-

I am at least 90% cash right now and may be 100% cash by the end of the day. There are no numbers suggesting this current stock market explosion is based on anything but hope. Just factoring in the people falling off of unemployment is a very serious hit to the economy. I do market time when it is obvious. The coming downturn is as obvious as the previous one.

———————————————————————————————————————-

The power traders will come back from their homes in the Hamptons after Labor Day and smack the @#$%&! out of this high market.

———————————————————————————————————————-

No matter how much you wish and sweet talk it, it’s a crash waiting to happen.

October 1st, 2009 at 2:49 pm

[...] month ago, we wondered whether the stock market would suffer a September swoon. If your answer to that question was yes, and you acted on it, then you missed out on a nearly 4% [...]

April 14th, 2010 at 2:12 pm

[...] the stock market. Last fall, with stocks enjoying a half-year’s worth of gains, we asked if a September swoon was in the cards. A bullish month later, we wondered if an October apocalypse might prove the [...]