The jobs report report

August 7, 2009Jon Brooks Comments Off While scouring economist blogs to try to get a handle on what the dismal scientists make of today’s seemingly positive unemployment report, I noticed that the Economist’s View blog, maintained by Mark Thomas of the University of Oregon Economics Department, had already done that. His Jobs Report Roundup includes the salient points of a dozen or so posts by economists on their blogs.

While scouring economist blogs to try to get a handle on what the dismal scientists make of today’s seemingly positive unemployment report, I noticed that the Economist’s View blog, maintained by Mark Thomas of the University of Oregon Economics Department, had already done that. His Jobs Report Roundup includes the salient points of a dozen or so posts by economists on their blogs.

While some news outlets portrayed the report in the most positive light, and the stock market reacted with another gain, some economists aren’t so sanguine. From the sourpuss set:

Dr. Nouriel Roubini, from RGE Monitor:

All elements of total labor income–jobs, hours and average hourly wages–are under pressure, which will impact consumption in the coming months. The unemployment rate in late 2009 will be higher than what was assumed for 2010 in the adverse scenario of the banks’ stress tests. This will lead to further delinquencies on loans and securities and lower-than-expected recovery rates. As people with mortgages lose their jobs, they will have severe difficulties servicing their mortgages.

Be careful with these figures, though. They don’t include the increasing numbers of people working part-time who’d rather have full-time jobs. Nor do they include a large number who have given up looking for work. They don’t reflect the many millions who have found new jobs that pay less than the old ones they lost. And they don’t include one of the shortest typical workweeks on record, for those who still have full-time jobs. (On this score, though, another indication that things are worsening more slowly — the workweek went up very slightly from 33 hours.) Nor, for that matter, do the numbers reflect the 130,000 people who are coming into the labor force each month ready and willing to work, who can’t find jobs.

If all these people are included, my estimate is that one out of five Americans who would otherwise be working full time are now underemployed. We are still experiencing the biggest decline of any post-World War II economic slump.

And Chad Stone, Chief Economist at the Center on Budget and Policy Priorities:

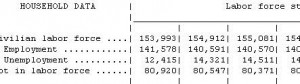

Although the pace of job losses has slowed considerably in recent months, private and government payrolls combined have shrunk for 19 straight months, and net job losses since the start of the recession total 6.7 million. (Private sector payrolls have shrunk by 6.9 million jobs over the same period.)Despite some stabilization in the unemployment rate, the percentage of the population with a job continued to trend down, reaching 59.4 percent, its lowest level since April 1984.

The Labor Department’s most comprehensive alternative unemployment rate measure — which includes people who want to work but are discouraged from looking and people working part time because they can’t find full-time jobs — edged down to 16.3 percent in July. The July figure, however, is 7.6 percentage points higher than when the recession began, and levels reached in this recession are the highest on record in data that go back to 1994.

Geez, fellas, someone please pass the cyanide!

True, there were some who did not overlook the silver lining of a lower jobless rate, but it never hurts to diminish expectations. Witness President Obama…