September 8, 2009Jon Brooks

As we’ve already seen, courtesy of the health care debate: Ideologies are colliding within people’s very own Friends List on Facebook. Another such interaction:

As we’ve already seen, courtesy of the health care debate: Ideologies are colliding within people’s very own Friends List on Facebook. Another such interaction:

FREE-MARKET GUY: It is contradictory to claim that a person has a right to a good or service that requires the violation of someone else’s rights. If the exercise of a patient’s so-called “right” to healthcare imposes obligations on taxpayers to pay for it and healthcare practitioners to provide it, then it is not a right, but an attempt to enslave one part of the population for the benefit of another part.

HEALTH CARE REFORM FAN: All rights within a society come at the expense of some limit of freedom on other members of that society. We choose to participate for the greater good. Using words like “enslavement” is just inflammatory. What’s next? Only people with school-age children should be taxed for public schools? I can see a lot of benefits to me personally in having other people’s children educated.

Continue Reading

September 7, 2009Jon Brooks

A hodgepodge of user-generated and other content from around the Web:

September 4, 2009Jon Brooks

You know the answer to that if you happened to catch Floyd Norris’s column in the New York Times today:

You know the answer to that if you happened to catch Floyd Norris’s column in the New York Times today:

“It was he who, at the end of 1861, figured out that the American government simply needed to print money to pay for the Civil War. It was economic heresy then, but without it this country might not have survived. Such an idea was then dismissed by some as “fiat money,” money that is money not because it is backed by gold or silver, but because some government says it is money.”

While that makes Spaulding a hero to some, it may also render him the moral equivalent of Satan to those who object to the trillions of new dollars the government’s printing presses are working so hard to generate. But for our purposes, the most outstanding thing about Spaulding is that his book relating to that period in history is available for free online. Check out the complete and unpithily titled

History of the legal tender paper money issued during the great rebellion, being a loan without interest and a national currency at the

Internet Archive or

Google Books.

And tell ‘em Ben Bernanke sent you…

September 4, 2009Jon Brooks

Referring to the current recessionary cycle,  Joseph Stiglitz says we may be in for a W-shaped recovery. Norel Roubini thinks we could go W or U. George Soros said he didn’t see a V anywhere in site.

Joseph Stiglitz says we may be in for a W-shaped recovery. Norel Roubini thinks we could go W or U. George Soros said he didn’t see a V anywhere in site.

What, exactly, are they talking about? Let us consult the Wiki.

V-shaped recession: “The economy suffers a sharp but brief period of economic decline with a clearly defined trough, followed by a strong recovery.”

U-shaped: “Longer than a V-shaped recession, and has a less-clearly defined trough. GDP may shrink for several quarters, and only slowly return to trend growth.”

W-shaped: A “double dip” recession, occurring when the economy “emerges from (a) recession with a short period of growth, but quickly falls back into recession.”

L-shaped: “The economy has a severe recession and does not return to trend line growth for many years, if ever…This is the most severe of the different shapes of recession.”

Some have also talked about a J-shaped recovery. But at this point, any recovery might just be termed “A-OK.”

September 4, 2009Jon Brooks

Interesting post on the naked capitalism blog today, taking off on Nobel Prize winning economist Joseph Stiglitz’s comment that the U.S. may be in the middle of a W-shaped—or double dip—recession. Which means another economic contraction sooner rather than later. As poster Yves Smith sees it:

The real issue is the ongoing con job. Team Obama has made it clear that it sees restoring confidence as paramount, when anyone with consumer marketing experience will tell you that advertising campaigns that make exaggerated claims about the product often don’t simply fail (as in customers see through the hype) but often backfire (buyers discount future ad messages about the product). The press has had a manipulated feel (with) misleadingly positive stories with Panglossian headlines and upbeat initial paragraphs that are often undercut by other material in the same article.

So in our new branding, “the economy is no longer in a freefall” has become “recovery.” The self-congratulatory tone among US financial regulators (who should instead be engaging in serious self-recrimination for failing to foresee and prevent this crisis) is premature. The financial system has been patched up and put back together with considerable continued official support, and more important, policies in place that allow banks to go back to the craps table with the taxpayer sopping up any mess. This is not a sound foundation for growth.

If we could only come up with a slogan for our woes that raises hopes—but not expectations. Howzabout: “America—stay tuned.”

Speaking of Stliglitz, he’s also the former Chief Economist for the World Bank who became a whistle-blower of sorts after he

criticized the IMF for what he characterized as destructive and doctrinaire free-market policies. Check out his Columbia University page for an

archive of speeches going back to his World Bank days.

September 3, 2009Jon Brooks

Okay, you’ve either been frantically looking for work or just scraping by, when one day you open your mailbox to find—other than a tax audit—the most consistently unwelcome piece of mail in contemporary society—a jury summons. To that end, the New York Times ran a piece the other day with the headline “Call to Jury Duty Strikes Fear of Financial Ruin.” Lots of comments posted on that one, with similar conversations all over the Web about jury duty and how to get out of it due to economic hardship. Some of the more interesting posts:

Okay, you’ve either been frantically looking for work or just scraping by, when one day you open your mailbox to find—other than a tax audit—the most consistently unwelcome piece of mail in contemporary society—a jury summons. To that end, the New York Times ran a piece the other day with the headline “Call to Jury Duty Strikes Fear of Financial Ruin.” Lots of comments posted on that one, with similar conversations all over the Web about jury duty and how to get out of it due to economic hardship. Some of the more interesting posts:

Don’t lie

I work for a federal court. In my experience, although it varies from judge to judge and case to case, most would let you off during jury selection…

Don’t try any nonsense about how you’ve read about the case or trump up some extreme prejudice or outlandish excuse. It won’t work and will upset the court, which is never in your interest. I mean, seriously, do you think the federal judge has never seen someone put on a show to get out of being on a jury? Don’t say anything that’s not true, because the wrong judge on the wrong day just might ask to call the hospital your dear grandmother is staying in or ask for the receipt for the trip you’ve been planning for years or whatever. I assure you, you don’t want to be that guy.

Don’t phone it in

(If you got picked), maybe there’s some way to keep your business going during the trial– maybe hire an answering service or a virtual assistant to take calls, which you can return on breaks…I’ll really, strongly suggest that if you do return calls on breaks, TURN OFF YOUR CELL PHONE when you’re in court. Judges go ballistic when cell phones ring…

Continue Reading

September 2, 2009Jon Brooks

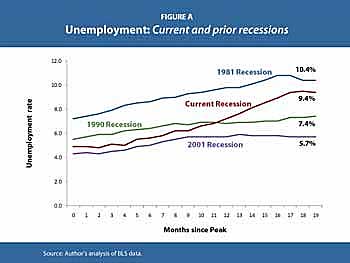

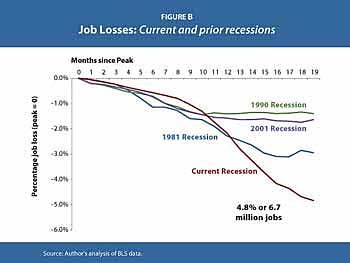

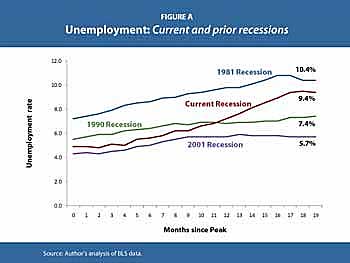

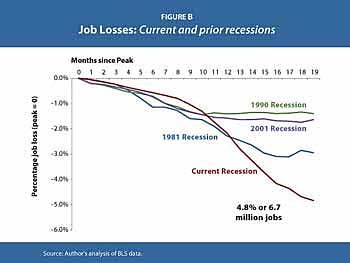

The Economic Policy Institute has posted some charts and analysis comparing the jobs deterioration in this recession and previous downturns. What did they come up with? Hint: It’s not pretty. These two charts are particularly telling:

“Employment has decreased much more during this recession—4.8%—than in prior recessions. In particular, during the first nineteen months of the recession of 1981/1982, employment declined by only 2.9%”

“Employment loss during the first eight months of this recession was relatively mild compared to previous recessions but then it fell off a cliff and now far surpasses the employment loss of the early 1980s.”

And of course, if you happen to be a data point on these graphs, it’s even worse than that…

September 2, 2009Jon Brooks

If you happen to be in Cambridge, Massachussetts on October 8th, drop in on a lecture by Marc Hauser, Director of the Cognitive Evolution Lab at Harvard: How Apes and Monkeys May Help Us Understand the Economic Crisis. Hauser will argue that “many of the problems in our own economic decision-making can be traced back millions of years when our primate ancestors were small-brained quadrupeds lacking any concept of money or the stock market.” Hmm. Sounds like some financial advisors we know.

If you happen to be in Cambridge, Massachussetts on October 8th, drop in on a lecture by Marc Hauser, Director of the Cognitive Evolution Lab at Harvard: How Apes and Monkeys May Help Us Understand the Economic Crisis. Hauser will argue that “many of the problems in our own economic decision-making can be traced back millions of years when our primate ancestors were small-brained quadrupeds lacking any concept of money or the stock market.” Hmm. Sounds like some financial advisors we know.

Some ideas espoused by Hauser, gleaned from

here and

here.

- In experiments with mirrors, great apes have demonstrated self-awareness, a trait closely linked to knowledge of what others know and don’t know. Great apes and monkeys use this information to both teach and deliberately deceive.

- Despite signs of empathy, cooperation, and “reciprocal altruism,” neither guilt nor shame, qualities necessary to a true morality, have yet to be scientifically observed in non-human animals.

- Chimps are more patient than people.

- Whereas humans are apt to punish those they consider to be unfair even at a cost to themselves, chimps will not make that choice. Extrapolating from that: Chimps do not exhibit a sense of fairness.

If you can’t make it to Cambridge, listen to this 2007 interview with Hauser on the ideas in his book “Moral Minds.”

September 1, 2009roman

In this first episode of EconomyBeat, KALW‘s Zoe Corneli goes on a ride-along with sheriff deputies as they evict people from their homes.

Podcast: Download (Duration: 9:51 — 6.9MB)

In Alameda County in Northern California, foreclosures have increased the number of evictions from about 300 to about 500 each month. The deputies who perform those evictions have a first hand look at some of the real life impacts of a down economy. This piece originally aired on KALW’s nightly news program

Crosscurrents. In the episode we also feature a clip from this little gem:

Do you have a piece you think should be considered for the EconomyBeat Podcast? Put it on PRX, and add the tag ‘ebpodcast’.

September 1, 2009Jon Brooks

September is the cruelest month – for the stock market. According to the data, if the leaves have started to fall, so have the major indices. In September, the Dow and S&P 500 have dropped on an average of 22 out of 30 days, the Nasdaq 17 of 30.

September is the cruelest month – for the stock market. According to the data, if the leaves have started to fall, so have the major indices. In September, the Dow and S&P 500 have dropped on an average of 22 out of 30 days, the Nasdaq 17 of 30.

The bulls having enjoyed a Pamplona-like run since March, the bears have been looking for an opportunity to end their hibernation. From the New York Times:

Some of the analysts and investors who called a bottom in March, when the markets hit their worst levels in more than a decade, now say they are detecting a peak in share prices, and they warn that stocks could be headed for a sharp pullback.

Everyone’s twitchy, especially after last year’s autumn disaster. 401k holders, daytrading dabblers, compulsive plungers. If September Day One is any indication, an implosion—self-fulfilling or otherwise—may be in the works. Asks “The Reformed Broker,” referring to the sharp sell-off: Did We Fall Off The Bull Today?

Continue Reading

As we’ve already seen, courtesy of the health care debate: Ideologies are colliding within people’s very own Friends List on Facebook. Another such interaction:

As we’ve already seen, courtesy of the health care debate: Ideologies are colliding within people’s very own Friends List on Facebook. Another such interaction: You know the answer to that if you happened to catch

You know the answer to that if you happened to catch