November 4, 2009Jon Brooks

This infographic, found on Boing Boing, is one way to starkly illustrate excessive CEO pay. It shows how many minimum wage earners it would take to equal the salaries of the top eight corporate chief executives in 2008. Click on the chart to see it full size.

November 4, 2009Jon Brooks

Ever see Woody Allen’s movie Take the Money and Run, in which his attempt at a bank robbery is thwarted because no one can read the hold-up note?

In real life,of course, crime and the desperation–economic or otherwise–that may impel someone to commit one is no laughing matter. Still, some of the details can be sort of interesting.

To that end: Bank Notes: A Collection of Bank Robbery Notes, all from unarmed robberies.

Most of these are models of concision:

Continue Reading

November 3, 2009Jon Brooks

…not this year’s Nobel Prize winner, Elinor Ostrom. Nor is it Christina Romer, chair of the President’s Council of Economic Advisers, or Laura Tyson, who held that position in the Clinton administration. According to the blog Economic Principals, which used Google Scholar to measure citation counts, the winner is Carmen Reinhart of the University of Maryland, co-author of This Time is Different:Eight Centuries of Financial Folly.

…not this year’s Nobel Prize winner, Elinor Ostrom. Nor is it Christina Romer, chair of the President’s Council of Economic Advisers, or Laura Tyson, who held that position in the Clinton administration. According to the blog Economic Principals, which used Google Scholar to measure citation counts, the winner is Carmen Reinhart of the University of Maryland, co-author of This Time is Different:Eight Centuries of Financial Folly.

From the Economic Principals post:

More to the point are the two electrifying papers that Reinhart and Rogoff brought to the yearly economic meetings in January 2008 and 2009. Both depended on a large historical data set the authors had compiled that in due course would be published as This Time Is Different. The first, “Is the 2007 US Sub-Prime Financial Crisis So Different? An International Historical Comparison,” persuaded a wide range of professional economists that the US economy was in for a terrific shaking – nine months before the banking crisis began.

The second, “The Aftermath of Financial Crises,” dispelled hopes that the recession would be an ordinary “v”-shaped variety, showing that financial crises, especially those involving asset bubbles, were almost always protracted affairs. Citations of the two papers are only now beginning to show up. Yet Reinhart and her co-authors have two papers with more than 2,000 citations and three more of around 1,000 each, dating back to 1993, analyzing previous crashes. Ordinarily, three or four papers of 300 citations or more are enough to make you a risen star: 575 for Christina Romer’s best-known paper, 265 for that of the more technical Athey.

So Carmen Reinhart. Remember that name. And you can read some of her book on Google Books.

November 3, 2009Jon Brooks

Last week’s positive GDP report got many people talking end of recession. But a glimpse at the economist blogs shows a more nuanced view:

From Econbrowser, written by two economics professors:

…The government sector made a smaller contribution than one might have thought given the fiscal stimulus, in part because lower state and local spending offset some of the increased federal spending. For a healthier long-run growth path I’d prefer to see business fixed investment and net exports adding rather than subtracting. But, compared with what we’ve been seeing recently, this overall is a quite welcome report.

But economist Tim Duy, on Seeking Alpha, points out the now-ended Cash for Clunkers’ contribution to GDP:

The more important question is what will be the durability and sustainability of the recovery in the years ahead? The GDP report raises some significant red flags when considering this question. The consumer spending number was clearly goosed by the Cash for Clunkers program and a much slower pace of inventory depletion than expected, which combined to add almost 2 percentage points to the headline figure. But auto sales have slipped back under the 10 million mark in September when the Clunkers program ended, with only a slight gain expected in October. And the slower inventory depletion suggests that firms are further along than expected in realigning stockpiles with demand, and that future improvement will need to stem from more significant improvements in underlying demand.

Continue Reading

November 3, 2009Jon Brooks

If the Internet is good for one thing, it’s making public the simmering cauldron of stored-up bile that you used to be able to drench only on friends, family, and pets. Most of these are dripping with sarcasm, and some are quite nasty. Which is understandable, perhaps. Maybe in a brutal recession like this, decorum is the first thing to go.

If the Internet is good for one thing, it’s making public the simmering cauldron of stored-up bile that you used to be able to drench only on friends, family, and pets. Most of these are dripping with sarcasm, and some are quite nasty. Which is understandable, perhaps. Maybe in a brutal recession like this, decorum is the first thing to go.

From Letters to Your Former Employer:

Dear Sneaky:

Thank you for shooting down every people-helping world-changing idea I submitted to you. I made the grave mistake of thinking that an anti-poverty anti-homelessness charity actually WANTED to fight poverty and homelessness. You are the embodiment of the religious hypocrite. You are the poster-child of the ‘Self-interested, Self-serving Cowards posing as good people of the World.’ …But mostly, you are a liar. I am just about done being livid about your ‘little mistake’ in the job description “Ooops, no, this job isn’t permanent, it is temporary, and now it is over, Bye!” I am freaked out, penniless, jobless, and angry, but I am already getting over it. Many other people are much worse off than I am. So, I am going to grab some guts, face up to my unfortunate situation, and then, I am going to go and actually change the world for the better. Things are crumbling and grim. They are scary and hard. But I will survive and do well. Oh, and so will other people who aren’t self-serving lazy cowards. You’re on your way out buster. No one has time for people like you any more. You are a bad person. I look forward to observing your karmic fall from esteemed position to public spit receptacle.

Continue Reading

November 3, 2009Jon Brooks

Haiku mania continues. Coming to us over the Facebook transom from Patricia Milton:

The cash for clunkers

program worked. Shiny new cars

in foreclosed driveways.

November 2, 2009Jon Brooks

Whether we’re experiencing another stock bubble now is a matter of opinion. But this post from The Consumerist pointing to the front page of the Wall Street Journal the first time the Dow broke 10,000–in 1999–is a good reminder of the kind of cheering-section sentiment tossed around in the middle of such an asset-inflated period. Check out the sub-head on the right: “Yes, the Values are Dizzying, But They Also Reflect Economy’s Rare Strength.”

November 2, 2009Jon Brooks

Facebook response to our last post on unemployment haikus, from a mother of three small children.

i work my ass off

but my only salary

is dirty laundry

November 2, 2009Jon Brooks

Economist Mark Thoma posted this graph on his blog Economist’s View.

Fellow economist Brad DeLong comments:

“It’s very scary: long-term unemployment has a way of turning into structural unemployment…”

November 2, 2009Jon Brooks

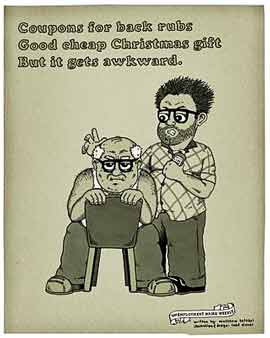

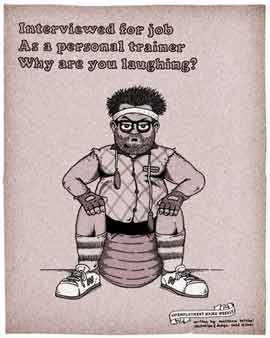

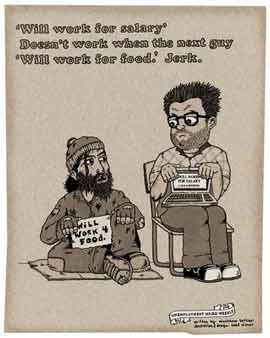

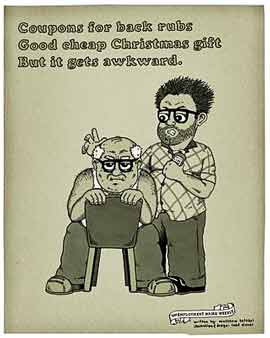

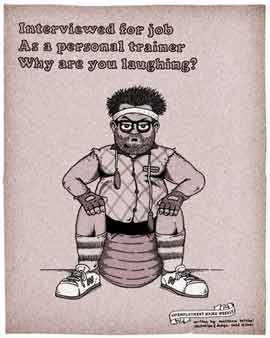

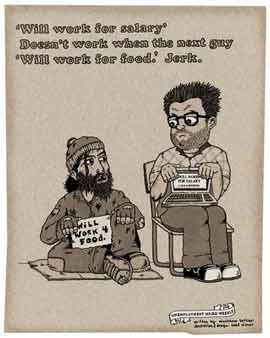

For about a year starting in July, 2008, laid off copywriter Matthew Bottkol and his artist pal Todd Eisner created an illlustrated unemployment haiku each week and posted it on Unemployment Haiku Weekly. Here’s just a sampling.

Check out our post Haikus for the times for more haikus.

If the Internet is good for one thing, it’s making public the simmering cauldron of stored-up bile that you used to be able to drench only on friends, family, and pets. Most of these are dripping with sarcasm, and some are quite nasty. Which is understandable, perhaps. Maybe in a brutal recession like this, decorum is the first thing to go.

If the Internet is good for one thing, it’s making public the simmering cauldron of stored-up bile that you used to be able to drench only on friends, family, and pets. Most of these are dripping with sarcasm, and some are quite nasty. Which is understandable, perhaps. Maybe in a brutal recession like this, decorum is the first thing to go.