October 30, 2009Jon Brooks

Yesterday we reported on well-regarded assets manager Jeremy Grantham’s prediction that the stock market is cruising for a 15-20% correction sometime this winter. In a section  titled “The Last Hurrah and Markets Being Silly Again,” he makes the comparison between the current rally and the 46% gain in the S&P 500 between November and April of 1930–after the initial market crash in October. That was before the index embarked on a vicious two-year decline that reached into the bowels of equities hell. Of course, when considering any market prognostication, it may be wise to heed the old axiom, “Nobody knows nuthin’.” Still, Grantham’s analysis is interesting and worth a read:

titled “The Last Hurrah and Markets Being Silly Again,” he makes the comparison between the current rally and the 46% gain in the S&P 500 between November and April of 1930–after the initial market crash in October. That was before the index embarked on a vicious two-year decline that reached into the bowels of equities hell. Of course, when considering any market prognostication, it may be wise to heed the old axiom, “Nobody knows nuthin’.” Still, Grantham’s analysis is interesting and worth a read:

The idea behind my forecast six months ago was that regardless of the fundamentals, there would be a sharp rally. After a very large decline and a period of somewhat blind panic, it is simply the nature of the beast.

After the sharp decline in the fall of 1929, the S&P 500 rallied 46% from its low in November to the rally high of April 12, 1930. It then, of course, fell by over 80%. But on April 12 it was once again overpriced; it was down only 18% from its peak and was back to the level of June 1929. But what a difference there was in the outlook between June 1929 and April 1930!…By April 1930, unemployment had doubled and industrial production had dropped from +16% to -9% in 5 months, which may be the world record in economic deterioration. Worse, in 1930 there was no extra liquidity flowing around and absolutely no moral hazard. “Liquidate the labor, liquidate the stocks, liquidate the farmers” was their version. Yet the market rose 46%.

How could it do this in the face of a world going to hell?

Continue Reading

October 30, 2009Jon Brooks

Click on an image to see it full size.

More photos here.

October 30, 2009Jon Brooks

From London, a lottery sign next to a newspaper headline. Entitled “A Tale of Two Lottos”.

October 30, 2009Jon Brooks

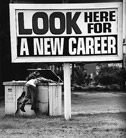

New Hampshire’s fared better than most states in the recession. But that just means unemployment is “only” 7%.

In response to the economic dislocation, New Hampshire Public Radio has created the Working It Out project, an archive of experiences and observations related to the recession reported by citizens from around the state. NHPR executive editor Jon Greenberg describes the endeavor in more detail:

While conventional wisdom, driven by macroeconomic statistics, has it that we have come out on the other side of the slump, it’s always instructive to check in with what’s happening on the ground before springing for champagne, let alone popping any corks.

To that end, some recent first-person news from the New Hampshire trenches, courtesy of Working It Out:

Living from one unemployment check to the next

I am a young single mother of a four-year-old boy and I was laid off in June. Jobs that I qualify for, during the hours that my son is at preschool and that pay enough to support my family are nearly impossible to find. We are living from one unemployment check to another and sometimes I am not sure where my son’s next meal is coming from. This economy has really tested my ability to make something out of nothing. It has also showed me how resilient I am and that I am not going to give up because at some point it has to get better.

Where do foreclosed families go?

It is distressing to see all the For Sale signs in front of houses and know that most of them are foreclosures that represent displaced families. On one hand it is a sign of the excess borrowing many did and on the other, it represents a family tragedy. I do wonder, where do all these people go to live? Do they move in with relatives?

Single parent and laid off

I used to have a good job at an electrics company. I made good money at work by high salary plus overtime. tTat made me more confident about bringing up my children by myself. (I’m a single parent.) But the company sent a lot of work overseas. That caused a lot of people to lose their job, myself included. Now I have to go collect unemployment, apply for electric assistance, and health care for my children. I really want to live and support my children on my own, but what should I do?

Continue Reading

October 29, 2009Jon Brooks

Here’s an excellent summary of the esoteric concepts and arcane financial instruments that contributed to the near collapse of the entire system last year. Created by designer Jonathan Jarvis as part of his thesis work.

Part 1

Part 2

October 29, 2009Jon Brooks

So far today, the major market indices are up on the heels of the government’s GDP report, which showed a 3.5% growth rate in the 3rd quarter–the strongest GDP increase in two years. Just two more days of non-catastrophe on Wall Street, and we’ll have avoided any unwelcome October Surprise.

So far today, the major market indices are up on the heels of the government’s GDP report, which showed a 3.5% growth rate in the 3rd quarter–the strongest GDP increase in two years. Just two more days of non-catastrophe on Wall Street, and we’ll have avoided any unwelcome October Surprise.

But one closely watched market guru says the market’s living on borrowed time and that a correction of 15%-plus is on its way. The blog Credit Writedowns posts a summar of Jeremy Grantham’s Quarterly Letter. Grantham is the chairman of the asset management firm GMO and is followed by many institutional investors and money managers. You can read his complete report here.

Just one man’s opinion, but he’s been right before…when most people were wrong.

Excerpts:

Seven lean years

…Corporate ex-financials profit margins remain above average and, if I am right about the coming seven lean years, we will soon enough look back nostalgically at such high profits. Price/earnings ratios, adjusted for even normal margins, are also significantly above fair value after the rally. Fair value on the S&P is now about 860 (fair value has declined steadily as the accounting smoke clears from the wreckage and there are still, perhaps, some smoldering embers). This places today’s market (October 19) at almost 25% overpriced, and on a seven-year horizon would move our normal forecast of 5.7% real down by more than 3% a year…

Continue Reading

October 28, 2009Jon Brooks

AlphaInventions is a blog search tool that is supposed to work in real time. From the “What is AlphaInventions” page:

If you update or publish your blog at the same time my visitors are browsing blogs in my site then my visitors will get a chance to see your blog in real-time. BAM! (the entire blog is in their face instantly) It’s not even annoying to watch. Is it, alpha addicts??

I also provide a link to your blog in case they want it to open your blog in a new window, or bookmark your blog. The links provides your title, and description to help my visitors get a better understanding on what your blog is about, and get more interested. Alphainventions.com is useful for wordpress.com , typepad.com, spaces.live.com, and blogger.com I love it, and want to grow it like a tree. Yahh!

Frankly, I’m still not entirely sure how it works. Go to the home page, and random blogs start flashing before your eyes like you’re having a near-death Web experience.

But you can also type in something in the search box, and the site will spit out 10 rotating blog entries on that topic. I put in “Joe Lieberman” for example–who yesterday threw a monkey-wrench into the congressional machinery looking to create a health care public option–and got these results:

Continue Reading

October 28, 2009roman

In this episode of the EconomyBeat, Detroiter Jean Wilson takes WDET‘s Zak Rosen to one of her favorite organic markets late at night. Well, actually, she takes him to the dumpster behind the market, to talk all about how she and a lot of other people are getting full for free in Metro Detroit. Jean Wilson has been diving for herself, friends, neighbors, and even her mother for more than five years. The 50-year old Wilson estimates she’s spent only $50 on food in the last five years!

In this episode of the EconomyBeat, Detroiter Jean Wilson takes WDET‘s Zak Rosen to one of her favorite organic markets late at night. Well, actually, she takes him to the dumpster behind the market, to talk all about how she and a lot of other people are getting full for free in Metro Detroit. Jean Wilson has been diving for herself, friends, neighbors, and even her mother for more than five years. The 50-year old Wilson estimates she’s spent only $50 on food in the last five years!

Podcast: Download (Duration: 7:24 — 5.2MB)

Do you have a piece you think should be considered for the EconomyBeat Podcast? Put it on

PRX, and add the tag ‘ebpodcast’.

October 28, 2009Jon Brooks

In our last post, we turned you on to the rap economics song “Demand Supply.” Now, thrill to eight more dope phat economics tracks, from the album “Flat World Economics” by Rhythm Rhyme Results.

Our recommendations include the R&B-flavored “Elasticity,” which should have you jutting your chin, swaying your hips, and assimilating the supply/demand curve’s sensitivity to price in no time flat. And definitely get your freak on to “Maximum Utility‘s” funky downbeat and economics-positive lyrics:

It’s the price of the good on the horizontal x

Over the price of the good on the vertical axis

Multiply this by negative one

That’s the slope of the Budget Line, but you’re not done, because…

Chorus

Maximum utility

Consumers acting rationally

They maximize their satisfaction

And we predict their actions

Let’s face it, the marriage of hip hop and macroeconomics was bound to happen. How long before Def Jam releases “F*** the supply-side!” by Paul Krugman?

October 28, 2009Jon Brooks

“Demand, Supply“

At first blush, you might think that Principles of Economics, written by Harvard professor and former chairman of the Council of Economic Advisors Greg Mankiw, doesn’t necessarily seem like ripe material for a rap adaptation.

At first blush, you might think that Principles of Economics, written by Harvard professor and former chairman of the Council of Economic Advisors Greg Mankiw, doesn’t necessarily seem like ripe material for a rap adaptation.

But if you did think that, you’d be wrong.

Listen to “Demand, Supply”, by Rhythm, Rhyme, Results. The rap song describes Mankiw’s 10 economic principles in a style somewhat reminiscent of Eminem — if Eminem rapped not about taking drugs, going mad, and hating women, but resource allocation, opportunity cost, and the money supply.

As in the book, topics in the song include government regulation:

Because of monopolies and the troubles they create

Uncle Sam comes along and he’s gotta regulate

That’s lesson #7: when government’s there

They oversee to guarantee that competition is fair

Continue Reading

titled “The Last Hurrah and Markets Being Silly Again,” he makes the comparison between the current rally and the 46% gain in the S&P 500 between November and April of 1930–after the initial market crash in October. That was before the index embarked on a vicious two-year decline that reached into the bowels of equities hell. Of course, when considering any market prognostication, it may be wise to heed the old axiom, “Nobody knows nuthin’.” Still, Grantham’s analysis is interesting and worth a read:

titled “The Last Hurrah and Markets Being Silly Again,” he makes the comparison between the current rally and the 46% gain in the S&P 500 between November and April of 1930–after the initial market crash in October. That was before the index embarked on a vicious two-year decline that reached into the bowels of equities hell. Of course, when considering any market prognostication, it may be wise to heed the old axiom, “Nobody knows nuthin’.” Still, Grantham’s analysis is interesting and worth a read:

So far today, the major

So far today, the major